I will focus here on few commonly used strategies that will help you understand the market trend. If you’re only going to read one book on options trading, let it be this one. Mark Wolfinger’s “The Short Book on Options” covers not just the basics of options trading, but strategies for utilizing this sector of the market with minimal risk, of course. Out of the money (OTM) – A call option is OTM if the strike price is greater than the current market price of the underlying asset. A put option is OTM if the strike price is less than the current market price of the underlying asset. At the money (ATM) – When the strike price of a Call or Put option is equal to the current market price of the underlying asset then it is in ATM.

How do I become an expert in option trading?

- Be Able to Manage Risk.

- Be Good With Numbers.

- Have Discipline.

- Be Patient.

- Develop a Trading Style.

- Interpret the News.

- Be an Active Learner.

- Be Flexible.

So, you always buy or sell in terms of the number of contracts and not the number of shares that each contract has. Trading in derivative market (Futures in Options) offers higher returns due to leverage provided. Both Stocks and Index can be traded in derivative market trhu thier options or futures contracts. The market is totally unpredictable and a breakdown from 4300 will trigger a panic selling in banknifty.

DEC FRIDAY – POST MARKET ANALYSIS

Author Joe Duarte was a biotech and healthcare analyst and is the author of « This Week in the Money » column. “The Option Trader’s Hedge Fund” shows readers how to approach options trading like a business—by setting up solid, reliable income from options trading. Authors Mark Sebastian and Dennis Chen explain how to set up a business model, setting up those income streams, and common pitfalls and troubleshooting, plus personal experience culled from their years of experience. Sebastian is the Chief Operating Officer of Option Pit Mentoring and Consulting, and Chen is the founder and Chief Investment Officer of Smart Income Partners.

4 new features to try out on your Kindle Scribe – About Amazon

4 new features to try out on your Kindle Scribe.

Posted: Mon, 22 May 2023 07:00:00 GMT [source]

Here is a screenshot of a portion of the option chain for Nifty taken from the NSE website. Traders can use option chain analysis to identify potential trading opportunities by examining the relationships between different options contracts and their corresponding prices. This analysis helps traders to determine the most favourable options to buy or sell based on their investment goals and risk tolerance. In this blog we will be learning the basics of option chain analysis for Nifty, Banknifty, Stocks and other indices with examples. For a beginner in Options trading, knowing option chain and analysing the data is very useful.

Best for Strategic Thinkers: Options as a Strategic Investment

McMillan also offers detailed advice on trading index options, trading options on futures, and measuring market volatility. Option chain analysis is also useful in evaluating potential profits or losses and identifying potential market trends or shifts in sentiment. By analyzing the option chain, traders can identify potential shifts in the demand for the underlying asset and make informed trading decisions based on this information. Every week in this weekly analysis article, we are covering nifty and bank nifty option chain analysis and trying to find the weekly support and resistance with the help of technical charts. Often doled out as required reading for those in the field, Sheldon Natenberg’s “Option Volatility and Pricing” is a solid choice for both amateur and professional traders looking for success in the options market. He’s also a member of the education team at Chicago Trading Company.

- If you don’t know how to analyze open interest for weekly option hedging strategies.

- The book is applicable to Intraday Trading, Swing Trading, & Positional Trading.

- It indicates the number of contracts that are closed or exercised.

- The book dives deep into using options as a hedge and explains how tax laws apply to option trading profits or losses.

- It tells us about what the market thinks on the price movement of the underlying.

- Book also covers 49 case studies that explain all the concepts in a practical and easy-to-understand manner.

In the money (ITM) – A call option is in ITM if its strike price is less than the current market price of the underlying asset. A put option is ITM if its strike price is greater than the current market price of the underlying asset. Now books on option chain analysis the chart is ready to be presented as a report for trend analysis in Options trading. You can also import the data for different expiry dates and automatically refresh it. Expiry Date – is the date at which the option contract expires.

Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits by Dan Passarelli

As an illustration let us choose Nifty Option chain and analyse the data. The Option chain data of the Nifty is specifically useful considering that it is one of the most liquid contracts and weekly options are also available on the same. Discover proven trading strategies, tools, and techniques to help you become a consistently profitable trader.

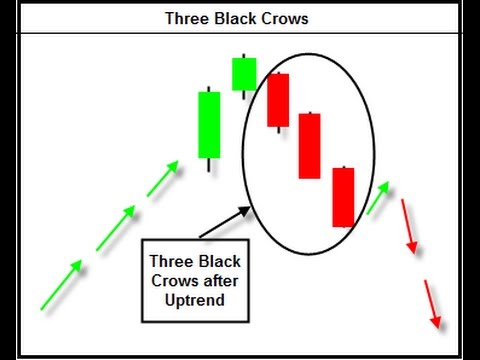

It is another indicator of traders interest in a particular strike price of an Option. Volume can help you understand the current interest among traders. And now, with his new three-book series—which focuses on how to use price action to trade the markets—Brooks takes you step by step through the entire process. The key features of the options chart that is used for building the strategy are Change in price, Open interest, Change in open interest, and Volume. Few strategies omit Volume, few include other features like LTP and Implied volatility.

The 6 Best Books on Becoming an Options Trader

It provides valuable insights into market sentiment and helps identify potential trading opportunities. By examining strike prices, expiration dates, and premiums, traders can evaluate risk/reward ratios and make informed decisions. Option chain analysis also assists in identifying potential support and resistance levels, understanding implied volatility, and formulating strategies to hedge or capitalize on market movements. Option chain is a list or table of all available option contracts. It includes stocks and index with put option and call option, for a given security. The table includes information on Open Interest, volume, Implied Volatility(IV), strike price, premium etc. of a option contract for a given exipration date.

Price Action Trading is a trading technique in which traders make use of only ‘Price’ and ‘Volume’ to make trading decisions. In this article, I am going to discuss the Option Chain Analysis in Trading. Please read our previous article where we discussed Opening Range Breakout with examples. At the end of this article, you will understand the following pointers in detail which are related to Option Chain Analysis.

How do you read an option graph?

To read the chart, you just look at any stock price along the horizontal axis, say $55, and then move straight up until you hit the blue profit/loss line. In this case, the point lines up with $500 on the vertical axis to the left, displaying that at a stock price of $55 you would have a profit of $500.